carbon tax benefits and disadvantages

A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions. A carbon tax can be very simple.

28 Crucial Pros Cons Of Carbon Offsetting E C

Although the carbon tax has some important advantages it also implies some problems.

. 1 Effects of Emissions Trading and a Carbon Tax. No matter how much gets emitted a carbon tax makes the emission the same. That may sound a little wonky but she added that she and many.

A number of disadvantages of carbon taxes are. Determining the Tax Rate That Best Balances the Benefits and Costs of a Carbon Tax 17 The Timing of Action 18 About This Document 20 Figure 1. Cap-and-Trade systems limit the amount of carbon dioxide that gets emitted but gives little control to the price.

Its an appealing idea but one that can be inordinately complicated as any company that has undergone this process can. Company A will pay 1275 to eliminate 50 units for itself Company B will pay 1122 to eliminate 33 units for itself. Carbon offsetting has benefits at both ends of the process.

The carbon tax is generally levied on fossil fuels. Carbon taxes according to research are the most efficient and effective way to. They cost lower income families more to implement on their own.

One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government along with providing an incentive to avoid the tax by reducing emissions. Advantages and Disadvantages of Carbon Tax and Environment Compensation Charge. Because CO₂ emissions from the combustion of fossil fuels coal natural gas and oil are proportional to the carbon content of the fuel a carbon tax is in effect a tax on CO₂.

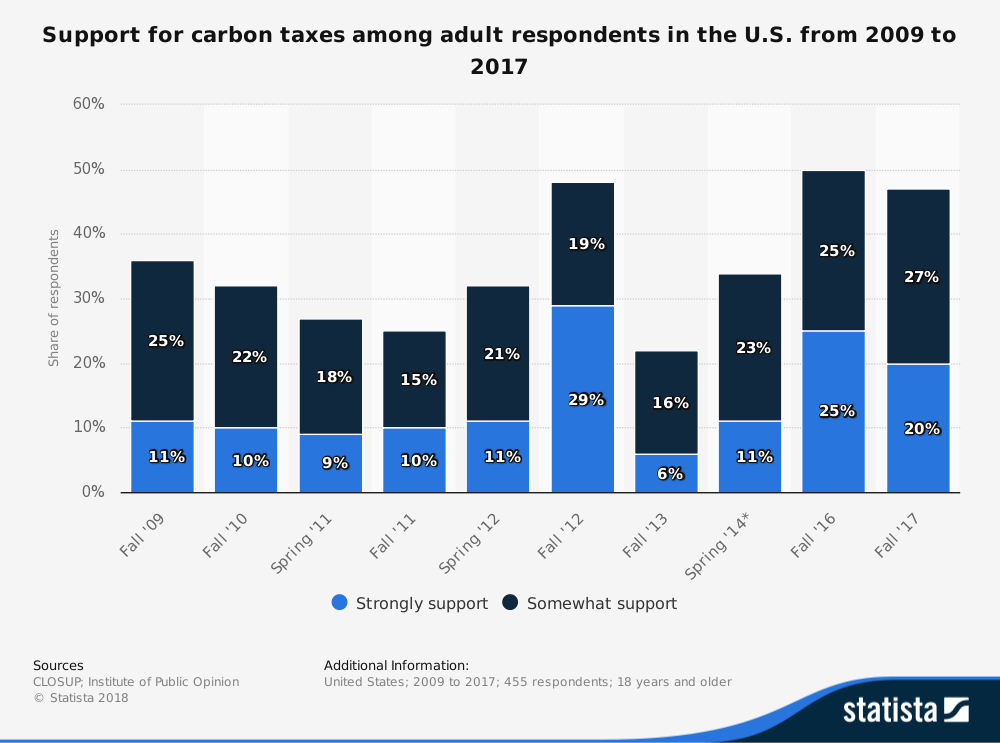

As Camila Thorndike the dynamic young leader of an effort to get a carbon price passed in Oregon told the Democrats at their platform hearings As a cross-sector and market-based solution a carbon tax empowers business to profitably transition to the clean-energy economy. That money could help offset energy costs for low-income families fund clean energy infrastructure help us adapt. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions.

Carbon tax as a reflection of societys willingness to pay to reduce the risk of potentially very expensive damage in the future. A carbon tax is a type of pollution tax that is levied on the use of carbon-based fuels coal oil gas. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price.

In households with low income the use of high emissions like heating homes and driving in public transportation often accounts for greater percent of the households income than in households with higher incomes. Lawmakers could increase federal revenues and encourage. Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax rate by 7 percentage.

The tax is imposed to protect the environment by reducing the production of greenhouse gases and carbon dioxide. Effects of a Carbon Tax on the Economy and the Environment. Under the carbon credits scheme.

Notwithstanding the introduction of the carbon tax and Environment Compensation Charge many commentators believe that India has a long way to go in terms of coal and petroleum pricing structures which have to move in tandem with developments in the countrys. Some countries have already adopted such a tax and discussions are ongoing in others. Whats worse if sufficient funds were not available at their disposal.

A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax. One of the most common announcements one hears from companies looking to improve their environmental impact is the decision to become carbon neutral often through carbon offsets. It imposes expensive administration costs.

The Congressional Budget Office estimates that with a tax of 25 per metric ton of CO2 emissions would be 11 lower in 2028 than currently projected. In that same timeframe this tax would also generate an estimated 1 trillion. It is a form of carbon pricing and aims to reduce global carbon emissions in order to mitigate the global warming issue.

Emissions but would have only a modest effect on the Earths climate without a worldwide effort. It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint. High prices for carbon-emitting goods reduce demand for them.

The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere. The Benefits and Drawbacks of Carbon Offsets. A carbon tax is a policy that would set a fixed price per ton of carbon or carbon dioxide emitted with a goal of incentivizing lower carbon emissions.

It is a tax imposed on products that emit greenhouse gases primarily fossil fuels. The tax would help reduce US. Carbon taxes makes emitting carbon dioxide more expensive.

Effects of a Carbon Tax on Labor Investment and Output 7. The carbon tax can be really expensive considering that the government would need a substantial amount of money for its implementation. The Pros of Carbon Offsetting.

A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources. It is easier and quicker for governments to implement. Many companies cant reduce their emissions as much as theyd like to.

Up to 24 cash back List of Disadvantages of Carbon Tax 1. A carbon tax also has one key advantage. 11 Price and Quantity.

Carbon Tax Pros And Cons Economics Help

Advantages And Disadvantages Of Carbon Tax Benefits

How Wind Power Is Harvested Infographic Wind Power Alternative Energy Wind Energy

27 Main Pros Cons Of Carbon Taxes E C

Advantages And Disadvantages Of Multiple And Single Sourcing Strategy Download Table

Carbon Tax What Are The Pros And Cons Climateaction

Advantages And Disadvantages Of Biomass Energy List Of Various Pros And Cons Of Biomass Energy A Plus To In 2022 Biomass Energy Biomass Renewable Sources Of Energy

Carbon Tax Pros And Cons Economics Help

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Regressive Tax Definition Advantages Disadvantages

Breathing Life Into Buildings With Natural Ventilation Natural Ventilation How To Increase Energy Ventilation

8 Pros And Cons Of Carbon Tax Brandongaille Com

Advantages And Disadvantages Of Different Modes Of Transport Logistics Management Transportation Supply Management

Carbon Tax Pros And Cons Economics Help

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Advantages And Disadvantages Economics Help

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com